In this article, we'll explain the tax management options currently available inside Kourses.

Our tax management features allow you to collect VAT for EU and UK customers when using Kourses checkouts.

Important notice:

The tax management features included within Kourses are the result of detailed research and consulting with experts on UK and EU tax requirements.

We are not tax experts on your individual situation, and as such you should consult with your own tax specialist to ensure you fully understand your tax obligations for your company in your country. We make no guarantee these tax features are suitable for your individual circumstances.

We accept no responsibility for costs, loss or inaccuracies as a result of using these features

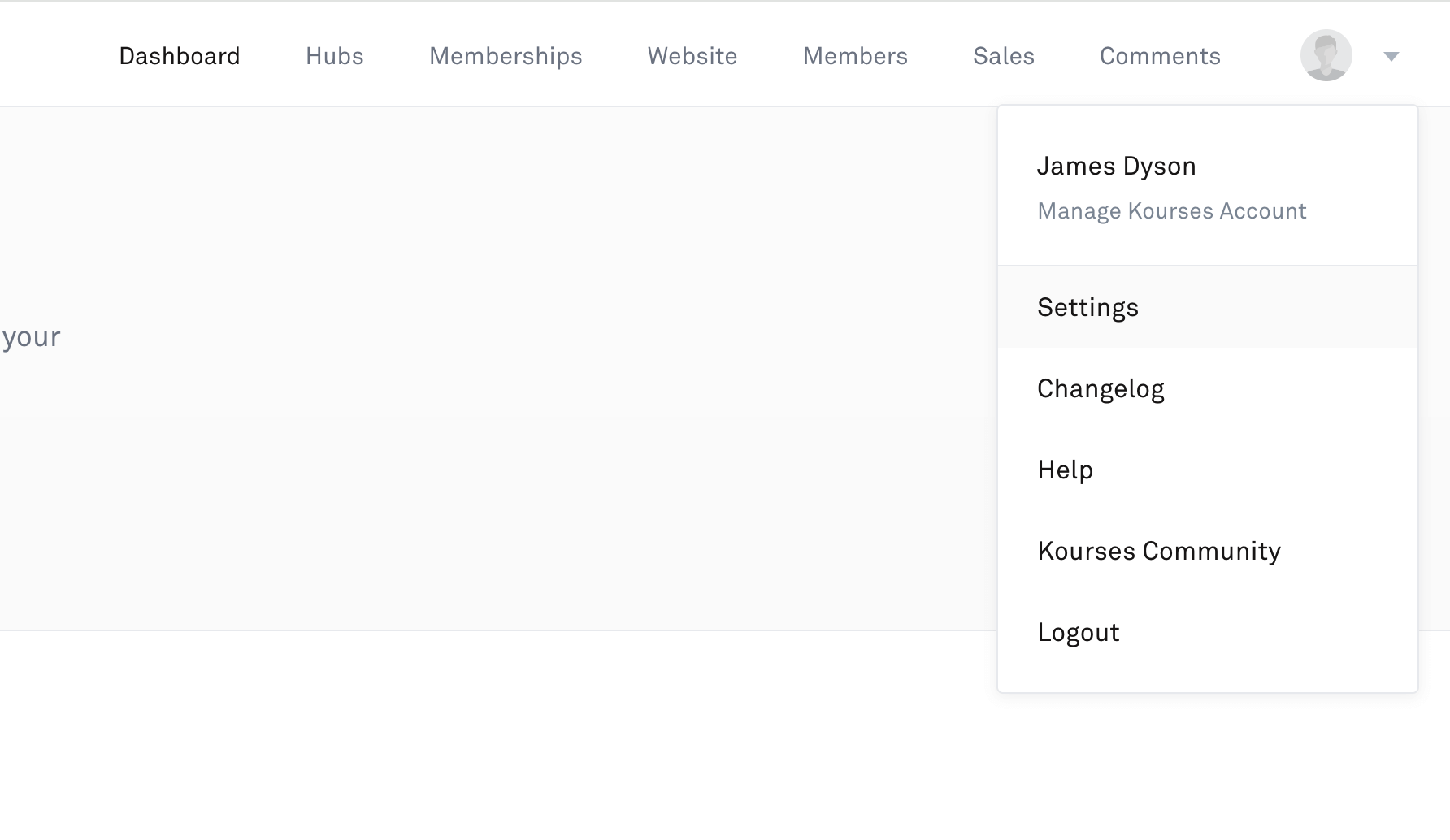

1. Locate the taxes settings

The tax settings for your Kourses account can be found by going to Settings > Taxes. You can find the settings menu by clicking the dropdown in the top right of your screen once logged in:

Once on the settings screen, click the taxes tab to open the taxes settings

2. Overview of taxes options available

The options shown to you on the taxes screen will depend on your business location. Certain options may be hidden as they are not relevant to tax requirements in your individual country. If you find you are missing a setting you require, please contact our team to discuss your individual tax requirements.

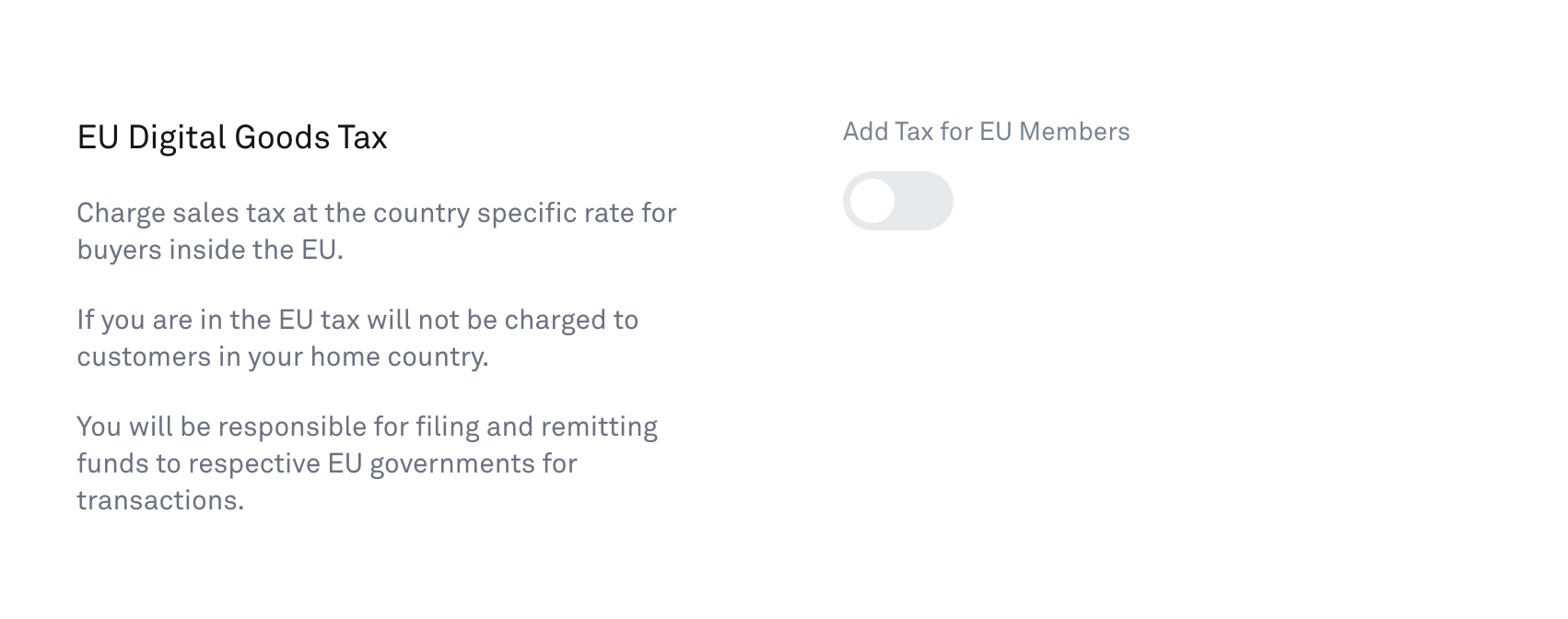

EU Digital Goods Tax

Who is this option for: Relevant to sellers based in all countries worldwide who sell to EU and are registered for EU VAT.

The EU Digital Goods tax option allows you to charge tax at the relevant country rate to your customers who are located in EU countries.

This option is suitable for any company Worldwide that is registered with an EU VAT number which allows for the collection of EU tax.

When activated, this option will do the following:

- Charge sales tax (at the specific country rate) to any customer in an EU country on checkout

- Allow a customer to provide a valid tax ID (we validate via the VIES Validation service) and company name to remove tax via the reverse charge method

- We store the customers location (checkout specified and IP) as well as tax amount and convert this to your own accounting currency as well as Euros.

At the end of each sales quarter, you will be able to generate a report which details the sales you have made to each EU country along with sales totals converted into Euros and your accounting currency (as specified in the Kourses settings). This will allow you to complete your VAT OSS reporting requirements.

Please note we do not handle submission of your VAT OSS reports - you will be required to handle that via the OSS portal you are registered with.

How to use this option

Toggle the switch on to begin charging tax on your checkout for EU customers.

If you are an EU based business, this option will NOT charge tax in your home country. To charge tax to customers in your home country, please use the "Charge tax in home country" option.

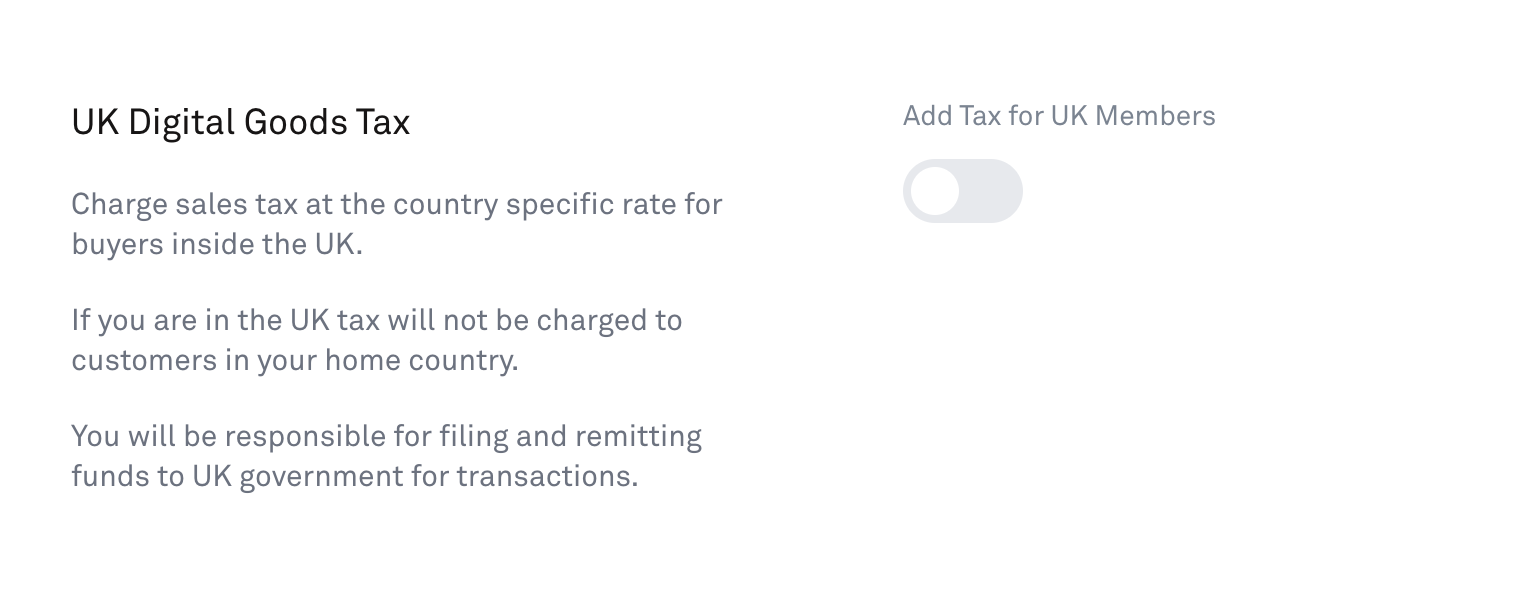

UK Digital Goods Tax

Who is this option for: This option will be available to all sellers located outside the UK. If you sell to customers in the UK and you have registered for UK VAT, you can use this option to charge UK VAT to UK Customers. You can learn more about registering for UK VAT here: https://www.gov.uk/register-for-vat.

The UK Digital Goods tax option allows you to charge your UK customers VAT at the current rate.

If you have registered for VAT in the UK (see link above to see if you are required to do so) - you can charge tax and collect relevant information required by using this option.

If your customer is a UK VAT registered business, they can provide a valid UK VAT number to remove tax from the checkout via the reverse charge method.

Please note this option is not designed for UK registered businesses, please see "Charge tax in home country" option for this.

How to use this option

Toggle the switch on to begin charging tax on your checkout for UK customers.

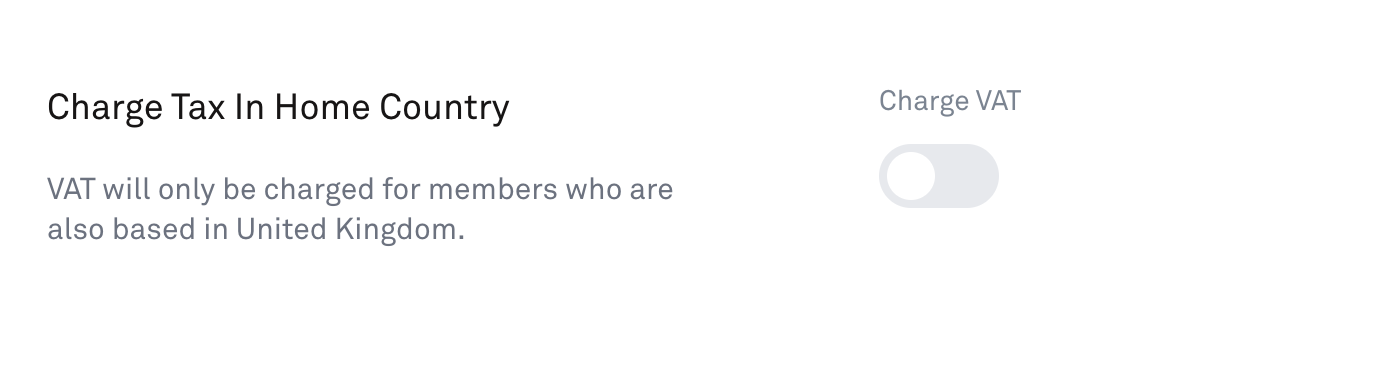

Charge Tax in Home Country

Who is this option for: For EU and UK based businesses that wish to charge tax to customers in their home country e.g. for UK businesses wishing to charge tax to other UK based customers.

If you're a UK or EU based business, by default our other tax options will not charge tax to your customers in your own home country.

To charge these buyers tax at your home country rate, you must activate this option.

Please note that reverse charge method does not take effect for these sales.

How to use this option

Toggle the switch on to begin charging tax to buyers in your home country.

Article tags: tax, taxes, tax settings, eu tax, vat oss, vat moss