When you use the Kourses checkout as an EU customer, we will automatically charge VAT due based on your selected country and the buyer country if you have activated EU VAT settings.

You can activate these settings by going to Settings > Taxes. You can find out more about these settings here.

When you use the EU Tax settings, we'll record various information required for EU quarterly tax submission and make this available in 2 downloadable spreadsheet/CSV reports.

Note: Please be aware that we are not tax lawyers or advisors and you should always consult your own advisor for specific advice that applies to your individual situation.

VAT OSS Report

The VAT OSS report will provide a list of transactions where tax has been collected, so you can use this to prepare your quarerly VAT OSS submission.

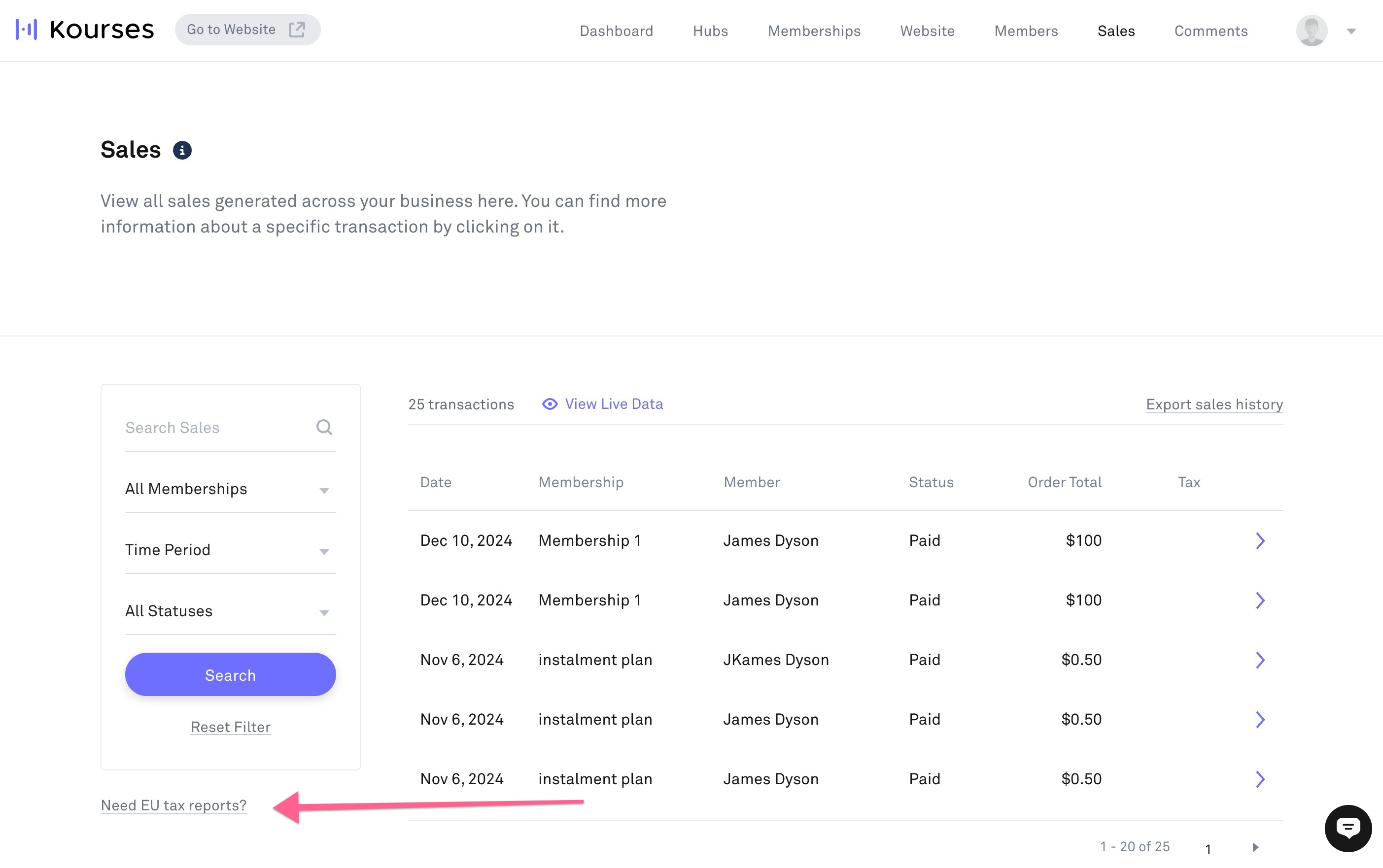

This can be downloaded by going to Sales > Need EU Tax Reports

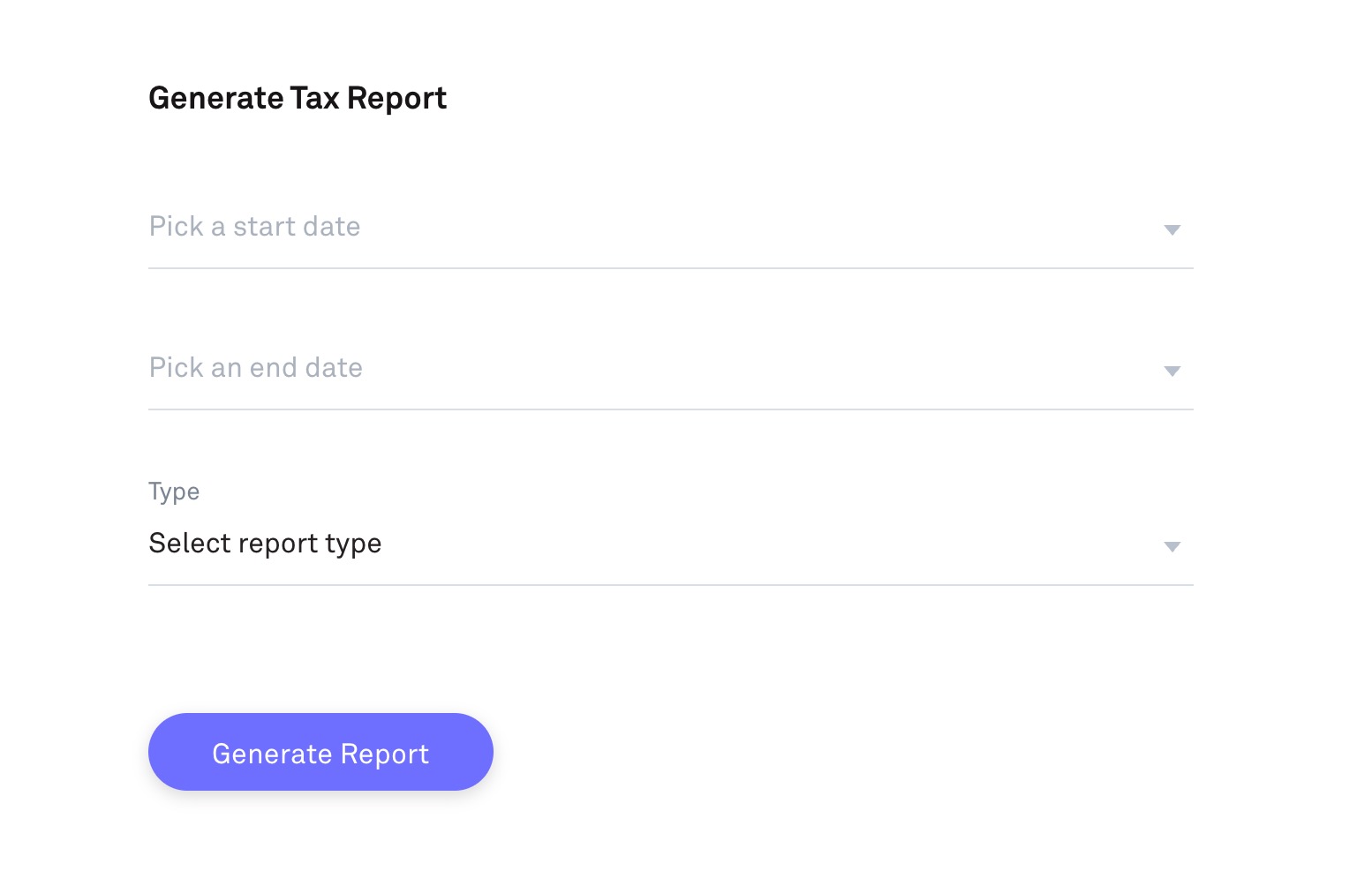

This will allow you to select the start and end dates for the tax report, and the type of report - which you can select VAT OSS.

Once you select the start and end date, and the report type - VAT OSS we will generate a download of a spreadsheet (in CSV format) with the following information:

- Country - 2-letter country code

- Tax name - The specific name of the tax in the country

- Tax rate - the % rate on the tax charged

- Eur Taxable Amount - The amount of the transaction converted into Euros

- Eur Tax Due - the amount of tax due - converted into Euros

- Accounting taxable amount - the taxable amount in your business accounting currency (selected in Kourses interface)

- Accounting tax due - Tax due amount in your business accounting currency.

This information can be used to complete your VAT OSS submission which is usually due quarterly. Please consult a specialist advisor to ensure you are compliant in your submissions.

Reverse Charge Report

The reverse charge report provides a list of transactions where EU tax was due but removed due to the reverse charge rules - this is where a customer provides a valid EU VAT ID and we therefore remove the tax due. This is compliant with EU VAT sales laws.

This report may be required by customers in some jurisdictions as part of the VAT return process.

This report can be accessed via the Sales > Need EU Tax Reports screen - by selecting Reverse Charge from the report type dropdown menu.

This report will provide the following information:

- Jurisdiction - Country code of the customer

- Tax ID - Validated VAT Id of the customer

- Customer - Customer name and company name provided

- Total - transaction total in the checkout currency